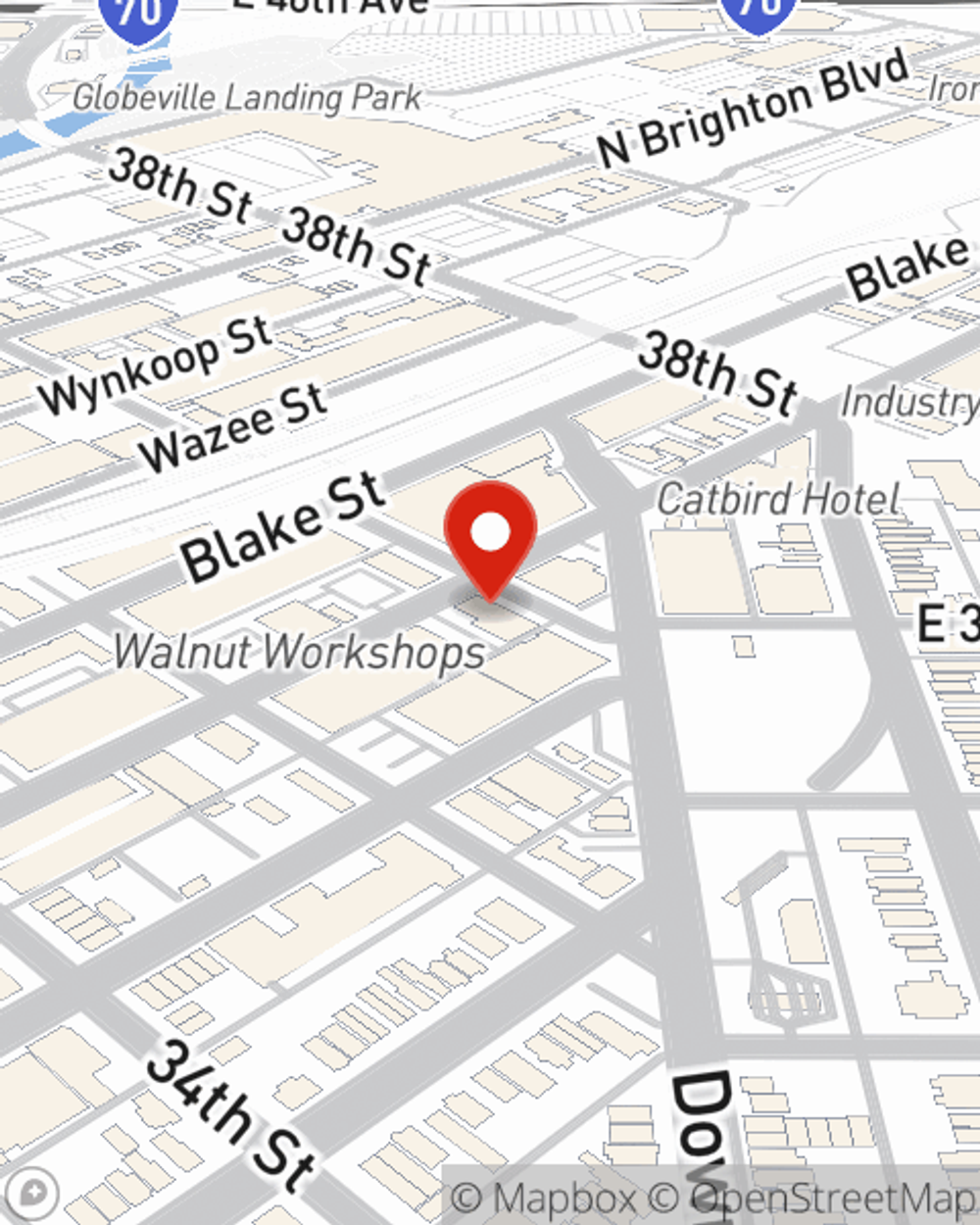

Business Insurance in and around Denver

Searching for protection for your business? Search no further than State Farm agent Mason Good!

This small business insurance is not risky

- Denver County

- Jefferson County

- Araphaoe County

- Highlands, Co

- River North, Co

- Arvada, Co

- Brighton, Co

- Thornton, Co

- Highlands Ranch, Co

- Lakewood, Co

- Centennial, Co

- Littleton, Co

- Fort Collins, Co

- Colorado Springs, Co

- Breckenridge, Co

- Vail, Co

- Aspen, Co

- Grand Junction, Co

- Steamboat Springs

State Farm Understands Small Businesses.

When experiencing the challenges of small business ownership, let State Farm be there for you and help provide great insurance for your business. Your policy can include options such as business continuity plans, errors and omissions liability, and a surety or fidelity bond.

Searching for protection for your business? Search no further than State Farm agent Mason Good!

This small business insurance is not risky

Get Down To Business With State Farm

Whether you own a photography business, a pottery shop or a cosmetic store, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Contact agent Mason Good to consider your small business coverage options today.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Mason Good

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.